State Services

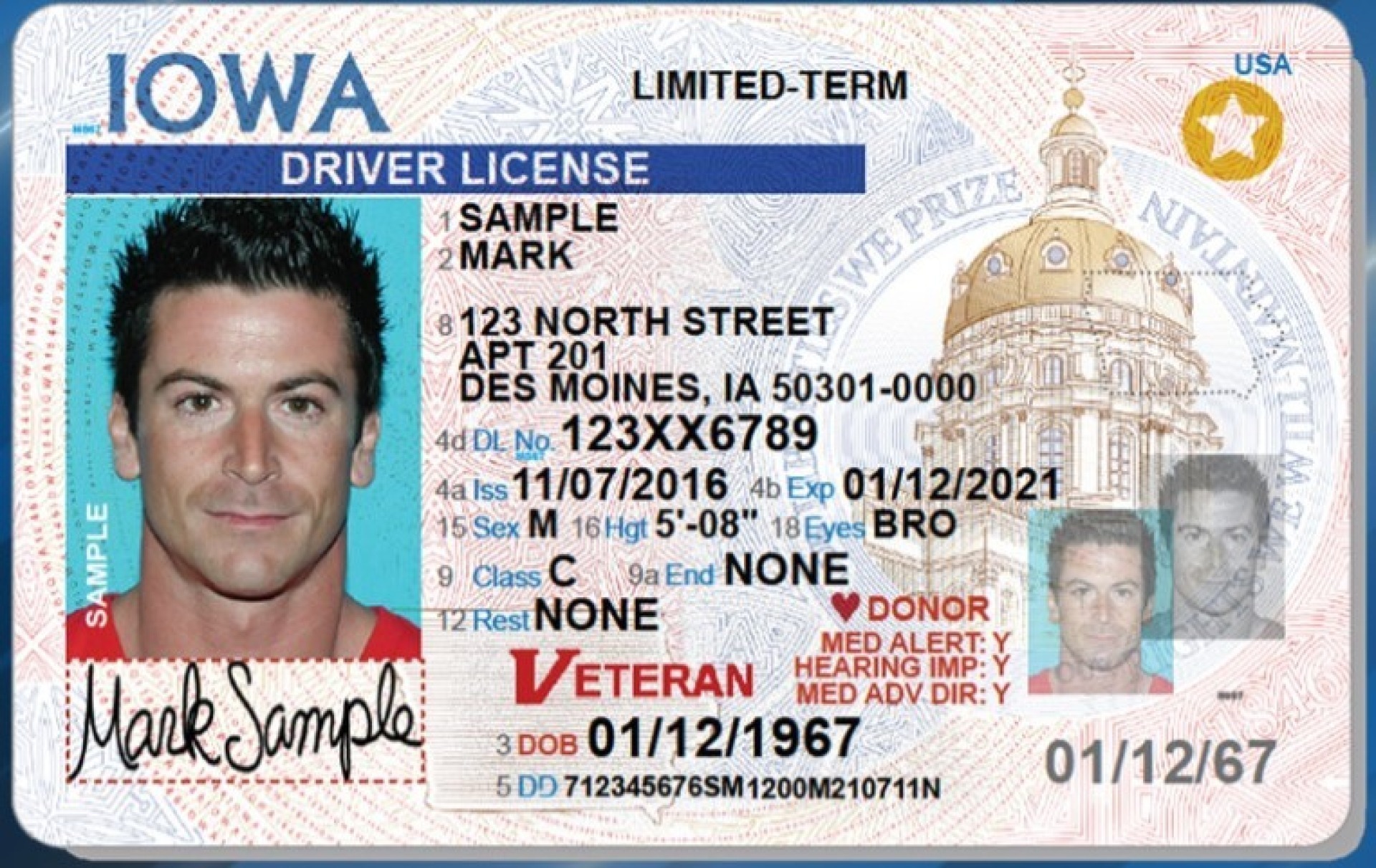

Veteran Drivers License

Veterans who were discharged under Honorable or General (under honorable conditions) may apply for a veteran designation on their driver’s license. Forms can be picked up at our office. In order to verify eligibility, a VSO will need to see a current driver’s license as well as a copy of the veteran’s DD214 in order to establish character of service and if the applicant meets the definition of “veteran” from Iowa Code Chapter 35.1. Further information can be found on the Iowa DOT website.

Veteran License Plates

Veterans who were discharged under honorable conditions may apply for veteran license plates. VSO staff will need a copy of your DD214 (other than member 1) which must show the dates and character of service. National Guard and Reserve members may apply but must have served at least 90 days of active-duty service other than training, or a minimum of 20 years of service and eligible for retired pay at age 60. More information on veteran status per the state of Iowa can be found in Iowa Code Chapter 35. Forms may be completed at our office. A personal check or cashier check should be presented at that time for any payment required. There is no charge for the first set of numbered plates. Second or subsequent sets are $25. The first set of personalized plates are $25. The second or subsequent sets are $50. Further information can be found on the Iowa DOT website.

Veteran Hunting and Fishing License

If you are a service-connected Iowa-based veteran, you can get a lifetime hunting and fishing license for $7. You must have your member 4 DD214 showing honorable service and will need a recent benefits summary letter from the federal VA showing that you have a service-connected disability.

Property Veteran Tax Exemption

Are you a veteran that has a property under your name and is currently living in the home? Please see our Accessor’s Office, you will need a good copy of your DD214, if one is not already submitted to the county records department. Applications must be completed and sent in by June 30th. If you are on 100% Permanent and total disability you are eligible for tax exemption. You must have your Benefit Summary Letter.

Surviving Spouses that are receiving DIC payments qualify for the credit. Receiving DIC payments means their spouses death was service connected. They are not required to have a 100% service connected disability rating as they qualify under Iowa Code section 425.15(1)(d).

100% Permanent and total disability tax exemption

If you are a veteran that has a 100% permanent and total rating for compensation. Please call our office and we can explain the steps to obtain your Benefit Summary Letter and schedule an appointment to complete the application. Once the application is completed it will be sent to the assessor's office

Veteran's Records

Finding a Veteran's Records

If a Veteran or loved one cannot find your discharge papers or military records, National Archives - Request Military Service Records, Iowa National Guard Record Center Documents Request or we can assist you. We will need as much information as possible to be able to find the records so please make sure you have the following:

- The Veterans name, DOB and SSN

- The Veterans branch of service and (approximate) dates of service.

If you are acting on behalf of a veteran, or if the veteran has passed, we will need to see proof confirming this before any information or documents can be handed over.